Modi Budget@10: GST crosses several hurdles, time for pole vault with merger of slabs and inclusion of fuel

Since the midnight introduction of the Goods and Services Tax (GST) on July 1, 2017, in a majestic ceremony in the Central Hall of Parliament, slowly but steadily the new indirect tax regime has crossed the hurdle race and is now ready for a pole vault.

After hitting many milestones including the introduction of e-invoicing, e-way bills, tax scrutiny for compliances, and improving capacities with technology, the next phase of the GST needs to be a high jump with the merger of tax slabs and bringing petrol, diesel and electricity under the tax regime.

As a relatively new tax regime, GST has been riding with many laurels on its back. From 65 lakh registered taxpayers in the initial phase, the figure has now surged to 1.4 crore, a noteworthy over 100 percent increase over the last six years. From around Rs 0.9 lakh crore monthly revenue in the first year of GST in 2017-18, the average collection till November 2023 stood at Rs 1.66 lakh crore.

With the initial streamlining completed, is it now the time to address the most challenging questions under the GST regime and stabilise the new indirect taxation as the most successful one?

Several key indicators delineate the narrative of GST's evolution over the past six years:

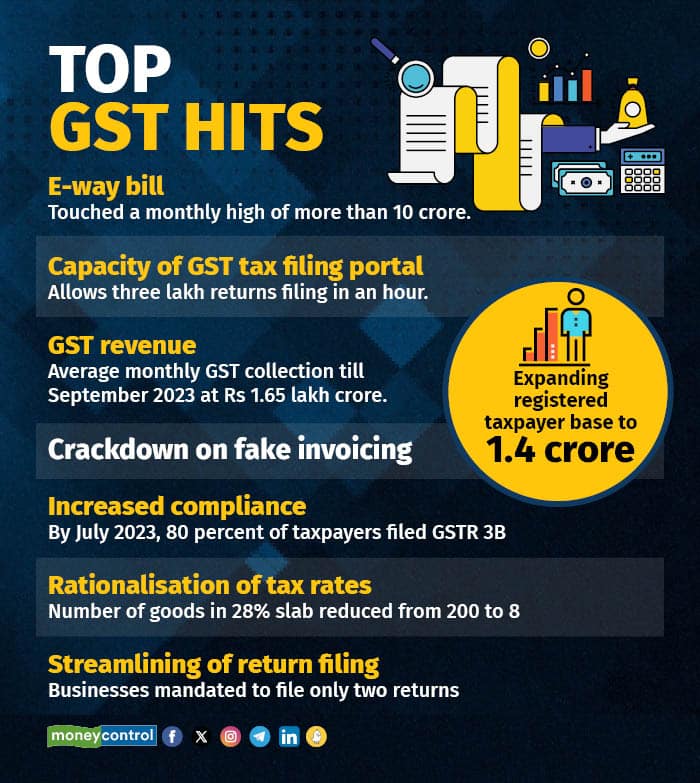

Top 5 GST hits

Top GST Hits

Top GST Hits

- E-way bill: Due to a rise in compliance e-way bill generation has touched a monthly high of more than 10 crore. The e-way bill system for the inter-state movement of goods across the country was introduced on April 1, 2018, and is mandatory for a threshold value of Rs 50,000.

- Capacity of GST tax filing portal: The capacity of the GST portal has been doubled which can allow three lakh returns to be filed in an hour. This is often expected to assist traders to some extent in filing returns.

- GST revenue above Rs 1 lakh crore per month: In the inaugural month of GST in July 2017, monthly collections amounted to Rs 92,283 crore. The average monthly GST collection till November 2023 stood at Rs 1.66 lakh crore.

- Expanding registered taxpayer base and formalisation of the economy: The substantial growth underscores a broadened tax base and the formalisation of the economy under the GST framework. Initially, GST compliance exhibited a gradual uptake. In the first month (July 2017), only 3.8 million out of 6.8 million registered taxpayers filed GSTR 3B returns by the due date. By July 2023, 80 percent of taxpayers filed GSTR 3B by the stipulated deadline.

- Crackdown on fake invoicing: The GST department conducted a two-month special drive in 2023 to crack down on fake invoices in sectors including scrap. Approximately 24,000 bogus entities were found with a total of Rs 63,000 crore fake invoices.

Top 5 GST misses

- Online gaming mess: The Directorate General of Goods and Services Tax Intelligence (DGGI) has sent 71 show-cause notices to online gaming companies for alleged GST evasion worth Rs 1.12 lakh crore. While online games were taxed at 18 percent GST earlier, and betting at 28 percent till October 1, 2023, the notices are based on the interpretation that all real money games come under the purview of betting. This has resulted in a flux of litigation cases.

- Inclusion of fuel and electricity under GST: The GST Council has failed to include electricity and fuel in the GST framework so far. Once these fall under the GST regime, manufacturers and refiners can offset a part of their tax liability by using input tax credit, which may lead to lower prices.

- Merger of rate slabs: With multiple rates under GST, a panel of state ministers was set up to suggest merging the 12 percent and 18 percent slabs into a single 15-16 percent levy but nothing has been proposed so far.

- Producing states complain of loss of revenue under GST: Producing states have been complaining of loss in revenue under GST, which is a consumption-based tax. Chhattisgarh, being a producing state, has claimed to have incurred a loss of Rs 3,000 crore per annum on coal alone under the GST regime as it is rich in natural resources.

- Delay in GST tribunals: The formation of GST appellate tribunals has taken many years after the enactment of the GST law and is now expected to become functional from the next fiscal.

Top GST Misses

Expert Speak

“The Model GST law has played a pivotal role in facilitating this transformation by harmonising all procedures, rules, forms, and case laws nationwide. This synchronisation has not only simplified tax compliance but has also increased transparency and accountability into the taxation process,” Rajat Mohan, Senior Partner, AMRG & Associates, told Moneycontrol.

A part of the transformation has been the rationalisation of tax rates. During the initial stages of GST implementation, more than 200 goods were categorised in the 28 percent tax bracket, which has now been reduced to just eight items. Additionally, tax rates for various goods and services have been reduced. For instance, the GST on restaurant services was lowered from 18 percent to 5 percent.

“Streamlining of return filing has also been a great achievement. Initially, the provision included three monthly returns – for sales, purchases, and a composite return – along with an annual return. Responding to business concerns about the compliance burden associated with 37 returns per year, the GST Council eliminated the purchase return requirement. Consequently, businesses are now mandated to file only two returns: GSTR1 for sales and GSTR 3B, a composite return,” Mohan said.

The industry believes that the time is ripe for the next phase of GST through forward looking reforms. These include easing of working capital for businesses, expanding the GST net to cover all sectors and rationalisation of certain provisions.

“The last 6 years have seen a consistent increase in the use of technology, with improved capacities. The next phase would be to move to a fully paperless economy. With audits and assessments in full swing, and given the period of limitation too, there is also an urgent need for a robust dispute resolution mechanism to be implemented. An essential first step in this process is the establishment of the GST Tribunals, which is long overdue,” Mahesh Jaising, Partner, Deloitte told Moneycontrol.

Looking ahead, the agenda for the GST system should include continuous refinement and enhancement, according to experts.

“This involves potentially bringing more sectors currently excluded like petroleum/ electricity under GST purview, operationalisation of GST appellate tribunals, rate rationalisation, updating technology for ease of doing business like application programming interface (API) for e-notices, sunset clause for anti-profiteering and clarifications on common issues impacting most businesses to avoid substantial litigation costs. The aim is to evolve the GST framework further, making it more robust, taxpayer-friendly, and supportive of the country's economic development,” Abhishek Jain, Partner, KPMG, told Moneycontrol.