GST Shock For Online Games Of Skill: Is There Still A Chance?

In less than a month, India's GST Council reassembled for its 51st meeting with a view to providing clarity on taxation of supplies in online gaming.

As per the press release1 issued after the meeting, the Council has recommended the imposition of 28% GST on the amount deposited by a player with the online gaming platform. Further, foreign online money gaming platforms catering to a person in India will be required to register and discharge GST. In case of failure to comply with provisions of registration and payment of tax, access to the platform can be blocked for users in India. It was also decided that efforts will be made to complete the process of making amendments by 1st October 2023.

Once the recommendation is given effect through an amendment, a person participating in an online game of skill will have to bear the burden of:

- 28% GST on the value of amount deposited;

- Depending on the outcome of the game, 30% TDS2 on the "net winnings";

- A fee of 10-20% charged by the platform.

This article attempts to understand the underlying rationale that prompted the GST Council to initiate this particular move which has been a blow to the gaming sector in India. Additionally, the article endeavors to offer perspectives on the complex subject of actionable claims, the implications of the retrospective levy of taxes and propose a way forward for the sector.

What was the intent of India's GST Council?

Legally, a clear distinction has traditionally existed between games of skill and games of chance. Games of chance, like gambling, are categorized as "res extra commercium," signifying their exclusion from regular commerce due to their association with sin. Conversely, games of skill are acknowledged as legitimate "business" activities and are afforded constitutional3 protection.

The Hon'ble Karnataka High Court in its recent judgment in Gameskraft Technologies Pvt. Ltd. vs. D.G. of GST Intelligence & Ors4 held that 'rummy' played online for a stake, would qualify as a game of skill as it tests the players' ability to strategize, think ahead and exercise alertness. The Court held that GST could only be levied on the fees paid by a player to the online platform and that the prize portion is excluded since it is an 'actionable claim'. The latest move of the GST Council is clearly aimed at overriding this Judgment as the proposed amendment seeks to bring 'actionable claim' portion in online games under the ambit of GST.

Is GST levy legally tenable?

The Apex Court5 has held that it was reasonable to tax only three actionable claims, which were lottery, gambling and betting. However, once the GST Council recommendations are implemented, online games of skill will be the only actionable claim (apart from the three on which GST levy was upheld by Apex Court) on which GST will be levied.

From a legal standpoint, this may be perceived as 'hostile discrimination' against online games of skill as other actionable claims (including offline games of skill played for money) continue to remain outside GST. It will be interesting to see if this levy is challenged and whether such challenge is sustained by Indian Courts.

When will the levy come into force?

The GST Council has set a target of 01.10.2023 for passing the amendments pursuant to the aforesaid recommendations in the Parliament as well as State Legislatures. However, given that the legislative actions required at the Central as well as State level (viz. review by Law Committee, passage by the Parliament, Presidential assent at the Central level and similar process at State levels) and reservations expressed by the State Governments of Delhi, Goa and Tamil Nadu, it appears to be an ambitious target. If made effective force from 01.10.2023, the Government may also face multifold implementational challenges similar to amendments made applicable to this industry on the income tax front.

Will GST levy be retrospective?

In their interactions with the media, Government officials have indicated that the proposed change is to be made by way of a 'clarificatory amendment'. This raises the issue of whether GST on online gaming may be retrospective. This would likely spell a certain doom and death knell for the industry.

Such statements may be an attempt to somehow safeguard the position of the Government in its Special Leave Petition filed before the Hon'ble Supreme Court against the Gameskraft Judgment (supra).

In the past, attempts of the Government to give amendments retrospective effect have been struck down by the Indian Courts6 in a few deserving cases and were given effect prospectively7.

Will this levy increase Government Revenue?

In recent years, the online gaming industry has experienced remarkable growth, transforming from an unregulated and informal sector into a formalized market. However, imposition of exorbitant taxes and regulatory compliance is posing significant challenges for both players and platforms. This situation may not only compel players to seek alternative options but also risks driving gaming platforms out of business or even forcing them to exit the Indian market, mirroring the previous experience with cryptocurrencies.

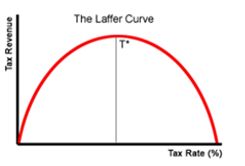

The higher tax rate is likely to have adverse effects on Government revenue as well. Illustrated in the figure, is an economic phenomenon - the Laffer curve theory8 depicts that exorbitant tax rates lead to decreased tax revenue.

Way forward

Considering the widespread concerns raised by the proposed amendment, a more favourable and thoughtful approach would have been to increase GST rate on platform fees portion only to 28% while the actionable claim continues to be excluded or levy GST at a lower rate (say 5%) on the amount deposited with the platform. It is hoped that such a favourable route may be adopted upon the review promised after six months of implementation.

While legal recourse to challenge the amendment is available, in parallel, businesses may have to restructure their model including deciding whether to charge platform fee separately, re-align revenue recognition practices and gear up for compliance with the new GST regime.

Footnotes

1. https://www.pib.gov.in/PressReleasePage.aspx?PRID=1945208 and https://pib.gov.in/PressReleasePage.aspx?PRID=1938812#:~:text=The%20Council%20has%20recommended%20to,also%20to%20clarify%20issues%20regarding

2. Section 194BA of the Income Tax Act, 1961

3. All India Gaming Federation & Ors. vs. State of Karnataka & Ors., [2022 (2) TMI 1368 - KARNATAKA HIGH COURT],

4. Writ Petition No. 19570 OF 2022

5. Skill Lotto Solutions Pvt. Ltd., vs. Union of India and others – 2020 SCC Online SC 990,

6. Commissioner of Income Tax (Central)-I, New Delhi v. Vatika Township Private Limited, 2015 (1) SCC 1

7. Greatship (India) Ltd. v. Commissioner of Service Tax, Mumbai-I, 2015 (39) STR 754 (Bom.)

8. The Laffer curve, as drawn by Economist Arthur Laffer, is a representation of the relationship between possible rates of taxation and the resulting levels of government revenue.