Energy industry asks for GST on petrol, tax exemptions in renewables from Budget 2023

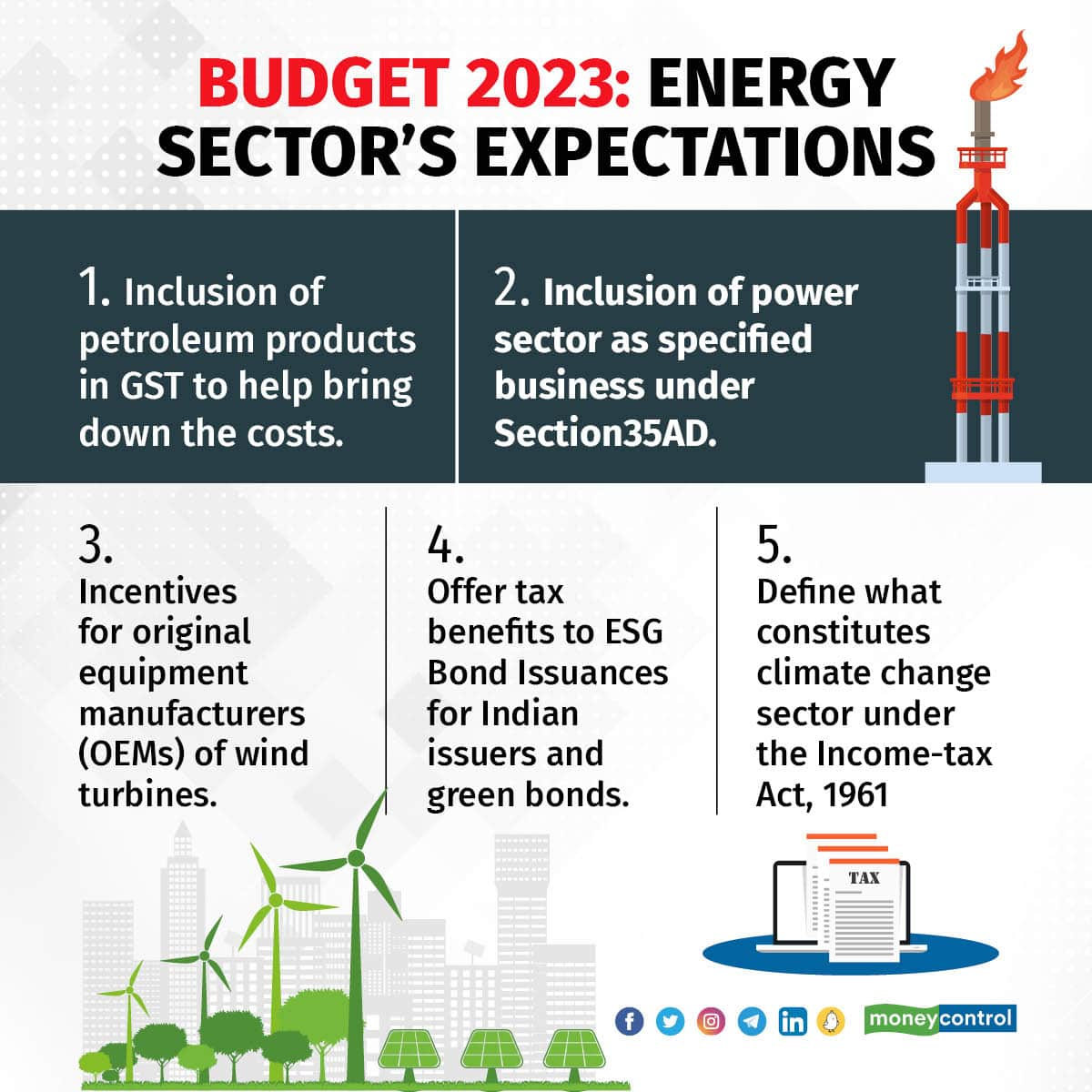

Industry organisations want petroleum products to come under the ambit of the Goods and Services Tax (GST) in Budget 2023, which Finance Minister Nirmala Sitharaman will present in Parliament on February 1, to lower costs.

The Confederation of Indian Industry (CII) said the government should consider bringing petroleum products as well as electricity tariffs and real estate under GST at some stage over the medium term.

To be sure, any decision on GST is taken by the GST Council, a joint forum of the Centre and the states. But a recommendation in the Budget by Finance Minister Nirmala Sitharaman, who heads the Council, can be a big positive signal.

“Until the time petroleum products are brought within GST net, suitable amendment in the excise laws be made to allow credit of GST paid on inputs/input services and capital goods against payment of excise duty to the manufacturers of petroleum products,” the Federation of Indian Chambers of Commerce & Industry (FICCI) said in a pre-budget memorandum.

The energy sector has been turbulent this year because of geopolitical tensions that triggered Russia’s invasion of Ukraine in February, disrupting supply chains, sparked interest rate increases that tightened credit markets and recession fears in the US and Europe.

The Russia-Ukraine war upended the global energy market, forcing even large economies to rethink their energy sources, targets and equations.

Actions against the climate change crisis—which primarily include reducing the reliance on fossil fuels—have also gained momentum as net-zero targets of many nations approach the end of this decade.

With less than two months left for the Union Budget 2023-24, industry organisations have put forward their expectations from the upcoming budget.

The year that was

Crude oil prices have been volatile since the Russia’s invasion of Ukraine. The price of a barrel of crude oil—which is currently trading below $80—hit a 14-year high of more than $139 in March.

In response to Russia’s invasion of Ukraine, G7 countries have imposed a price cap of $60 per barrel on the exports of Russian oil to undermine that country’s largest source of income.

Russia has diverted its oil supplies from its traditional market of Europe to countries in Asia. India has been benefitting from the discounts offered by Russia on crude oil since then.

Crude prices have come down in recent months due to deteriorating demand amid global inflation and recession fears. The volatility in the international market continues because the group of oil producing nations or OPEC+ often cut oil supply to support prices.

Similarly, the power sector in India faced its own challenges in 2022 as the country experienced acute power shortage because of shortages of coal supplies.

The shortages, coupled with high power demand due to scorching temperatures, led to a power crisis in the country in the summer.

Industry entities have urged the government to include the power sector as specified business under Section35AD, which permits a deduction of 100 percent of capital expenditure made during the previous year wholly and solely from company income.

“Power, railway redevelopment, and airport redevelopment projects have always been capital intensive. The inclusion, setup, and operation of renewable power plants, and redevelopment of railways and airports under the concession agreement should be included as the 'specified business' definition for Section 35AD,” said Deloitte.

Other demands of the energy sector include reduction of central excise duty on Aviation Turbine Fuel (ATF), withdrawal of the windfall tax on domestic oil production and providing 50 percent capital equipment subsidy or 6 percent yearly interest subvention, whichever is lower, to manufacturers of compressed bio-gas on capital goods.

Expectations for the Renewables Sector

With global pressure on countries for climate action, the Indian government is focussing on energy transition and pushing for renewable energy.

(Graphic: Rajesh Chawla)

(Graphic: Rajesh Chawla)

CII sought incentives for original equipment manufacturers (OEMs) of wind turbines.

“Provide Production Linked Incentive (PLI) benefits to Wind Turbine (OEMs) and component manufacturing for the development of new megawatt size turbines (3 to 5 MW); prototype development and full-scale production to meet the requirement of OEMs,” CII wrote in a pre-budget memorandum.

Carbon credits are an instrument used by companies to allow them to emit certain amount of greenhouse gases. Under Section 115BBG of the Income Tax Act, the government provides concessional tax of 10 percent on income from transfer from carbon credits if they are validated by United Nations Framework on Climate Change (UNFCC).

FICCI asked the government to extend the benefit to all the instruments issued under Indian regulations. “It is suggested that suitable amendments be made in Section 115BBG of the Act to ensure that the benefit is not restricted only to carbon credit units validated by the United Nations Framework on Climate Change,” said FICCI.

Deloitte urged the government to provide beneficial tax treatment for income from sale of Renewable Energy Certificates (RECs) as well. RECs certify that the owner owns one megawatt-hour (MWh) of electricity generated from a renewable energy resource.

"RECs are similar to carbon credits. Therefore, the concessional or NIL tax, similar to Section 115BBG, should be proposed with respect to income earned from the sale/transfer of RECs,” said Deloitte.

For achieving India’s net zero emissions target by 2070, CII suggested that a Development Finance Institution (DFI) in the climate and energy transition space in India.

It also wants a National Waste Management Authority with the mandate to help lay out Guidelines for Standardization of Request for Proposals across India, lower costs of green hydrogen through policy support like production-linked incentives for electrolyzers and cover green ammonia/green hydrogen under the definition of the infrastructure sector.

Another major ask for the renewables sector is to define what constitutes climate change sector under the Income-Tax Act, 1961, to clearly identify the types of sub-sectors or projects eligible for fiscal benefits.

“The definition will be a key element in identifying the target group that should get the fiscal incentives. A missing definition will lead to a wide interpretation of the climate change sector and dilute the objective of incentivising genuine participants trying to solve climate change problems,” Deloitte said.