Riddhi Enterprise ., In re

Date: January 21, 2025

Court: Appellate Authority for Advance Ruling

Bench: Gujarat

Type: Advance Ruling

Subject Matter

Readily available food and beverages (not prepared in the restaurant) sold over the counter do not qualify as 'restaurant services'. AAR ruling upheld.

FULL TEXT OF THE ORDER OF AUTHORITY FOR APPELLATE ADVANCE RULING, GUJARAT

At the outset we would like to make it clear that the provisions of the Central Goods and Services Tax Act, 2017 and Gujarat Goods and Services Tax Act, 2017 (hereinafter referred to as the `CGST Act, 2017′ and the `GGS’1.’ Act, 2017′) are pari materia and have the same provisions in like matter and differ from each other only on a few specific provisions. There unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act, 2017 would also mean reference to the corresponding similar provisions in the GGST Act, 2017.

2. The present appeal is filed under Section 100 of the CGST Act, 2017 and the GGST Act, 2017 by M/s. Riddhi Enterprise (hereinafter referred to as ‘appellant’) against the Advance Ruling No. GUJ/GAAR/R/2022/51 dated 30.12.2022.

3. Briefly, the facts arc enumerated below for ease of reference:

- the appellant is in restaurant business & is registered with the department;

- they offer a variety of food items & beverages prepared at the restaurant as well as readily purchased for sale over the counter;

- that there is no hotel accommodation;

- the applicant is of the opinion that the good and beverages whether prepared and supplied whether consumed in the restaurant or supplier over the counter is leviable to 5%GST with no ITC.

- the applicant is further of the opinion that the goods and beverages not prepared in the restaurant and supplied over the counter is also leviable to 5% GST with no ITC.

4. In view of the foregoing facts, the appellant had sought Advance Ruling on the following questions, viz:

1. Whether the food &beverages prepared & supplied by the Applicant to its customers whether consumed in the restaurant or by way of takeaway qualifies as restaurant services’ and is classifiable under SAC ‘996331: Services provided by restaurants, cafes and similar eating facilities including takeaway services, room services and door delivery of food’ leviable to GS7′ @ 5% with no input tax credit as per Sr. No.7(ii) of Notification No. 11/2017 – Central Mx (Rate) dated June 28, 2017,read with Sr. No. 7(h) of Notification No.11/2017 – State Tax (Rate) dated June 30, 2017?

II Whether the readily available food and beverages (not prepared in the restaurant) sold over the counter by the Applicant to the customer whether consumed in the restaurant or by way of takeaway qualifies as ‘restaurant services’ classifiable under SAC’996331: Services provided by restaurants, cafes and similar eating facilities including takeaway services, room services and door delivery of food’ leviable to GST @ 5% with no input lax credit as per Sr. No. 7(ii) of Notification No. 11/2017 – Central Tax (Rate) dated June 28, 2017, read with Sr. No.7(ii) of Notification No. 11/2017 – State Tax (Rate) dated June 30, 2017?

5. Consequent to hearing the applicant, the Gujarat Authority for Advance Ruling IGAAR1, recorded the following findings viz

- the appellant, engaged in restaurant business is supplying foods which is prepared cooked in the restaurant & also purchased from outside & sold over the counter in the restaurant premises;

- the activity of the appellant is of preparing food in the kitchen at the restaurant premises & serving the same to the customers who either consume it at the restaurant or at their place; that delivery of food is also done at the customers premises; that these activity gets covered under restaurant services in terms of circular no. 164/20/2021-GST dated 6.10.2021;

- that in terms of agenda item 9 of the minutes of the 23rd GST Council meeting held on 10.11.2017, it was clarified that all stand-alone restaurants, whether air conditioned or otherwise, shall attract GST 5% without ITC; that thod parcel/takeaway from restaurant shall also attract the same rate of GST;

- that food & beverages prepared /cooked in the restaurant & supplied to customers either consumed or by way of takeaway, will qualify as ‘restaurant services’, classifiable under SAC 9963;

- that the applicant is also engaged in purchasing food items from the market & supplying it from restaurant over the counter; that these food items are not prepared/cooked in the restaurant but purchased from the local market & directly supplied to the customers; that the customers may either consume it at the restaurant or at their place;

- the supply of already cooked/prepared food items purchased from local market, by way of takeaway does not fall within the ambit of ‘restaurant service’ instead it is a supply of goods;

- that in the AAAR ruling of Kundan Mishthan Lisandra, the appellate authority ruled that sale of sweets, nankeens cold drinks etc from sweetshop counter is supply of goods with applicable GST wherein ITC can be availed.

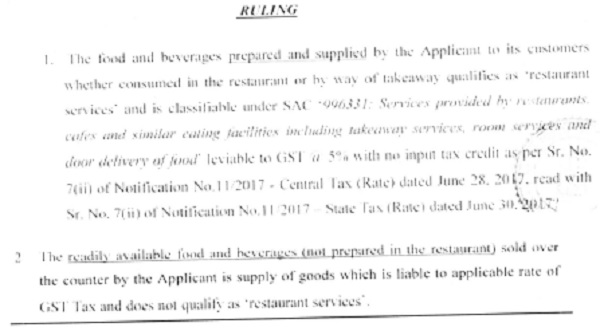

6. The GAAR, vide the impugned ruling dated 18.10.2021, held as follows:

7. Aggrieved by advance ruling with respect to question no. 2 given vide the impugned Ruling dated 30.12.2022, the appellant is before us, raising the following contentions, viz

- the definition of ‘restaurant service’ & Sr. No. 6(b) of Schedule II of the CGS’)’ Act. 2017, are identically worded;

- that the readily available food & beverages I not prepared in the restaurant & sold over the counter is deemed to be supply of service classifiable as ‘restaurant service’;

- that the GST Council has categorically stated that the intention is to levy GST @ 5% on restaurants irrespective of whether the goods is consumed in the restaurant or elsewhere and irrespective of whether it is prepared in the premises or merely sold over the counter;

- AAR misconstrued the AAAR ruling in the case of M/s. Kundera Mishthan lemandarin;

- that they wish to rely on the ruling in the case of M/s. Gangur Sweets2

8. Personal hearing in the matter was held on 08.11.2024, wherein Shri Chintan Vasa, CA appeared on behalf of the appellant and reiterated the grounds of appeal. During the course of personal hearing, the authorized representative submitted a copy of circular no. 201/13/202343ST dated 1.8.2023.

9. We have carefully gone through and considered the appeal papers, written submissions filed by the appellant, submissions made at the time of personal hearing, the impugned ruling and other materials available on record.

10. Before dwelling on to the issue, we would like to reproduce relevant portions of circular/clarification & the exemption notification for ease of reference viz

Schedule II

[see section 7]

Activities lor transactions) to be treated as supply of goods or supply of service

6. Composite supply

The following composite supplies shall be treated as a supply of services, namely:-

(a) ….; and

(b) supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where such supply or service is for cash, deferred payment or other valuable consideration.

>Notification No. 11/2017-CT (R) dated 28.6.2017 as amended vide notification No. 20/2019-CT (R) dated 30.9.2019, wef 10.2019

“(xxxii) “Restaurant service means supply, by way of or as part of any service, of goods, being food or any other article for human consumption or any drink, provided by a restaurant, eating joint including mess, canteen, whether for consumption on or away from the premises where such food or any other article for human consumption or drink is supplied.

>Circular No. I 64/20/2021-GST dated 6.10.2021 (relevant extracts[relevant extracts]

3. Services by cloud kitchens/central kitchens:

3.1 Representations have been received requesting for clarification regarding the classification and rate of GST on services rendered by Cloud kitchen or Central Kitchen.

3.2 The word ‘restaurant service❑ is defined in Notification No. 11/2017 —CTRas below: –

“Restaurant service ❑ means supply, by way of or as part of any service, of goods, being .food or any other article for human consumption or anydrink, provided by a restaurant, eating joint including mess, canteen, whether for consumption on or away from the premises where such food or any other article for human consumption or drink is supplied”

3.3 The explanatory notes to the classification of service state that “restaurant service❑ includes services provided by Restaurants, Cafes and similar eating facilities including takeaway services, room services and door delivery of food Therefore, it is clear that takeaway services and door delivery services for consumption of food are also considered as restaurant service and, accordingly, service by an entity, by way of cooking and supply offbod, even if it is exclusively by way of takeaway or door delivery or through or from any restaurant would be covered by restaurant service. This would thus cover services provided by cloud kitchens/central kitchens.

3.4 Accordingly, as recommended by the Council, it is clarified that service provided by way of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service 0, as defined in notification No. 11/2017-Central Tax (Rate) and attract 5% GST without ITC].

4. Supply of ice cream by ice cream parlors

4.1 Representations have been received requesting ,for clarification regarding the supplies provided in an ice cream outlet.

4.2 Ice cream parlors sell already manufactured ice-cream and they do not have a character of a restaurant. Ice-cream parlors do not engage in any form of cooking at any stage, whereas, restaurant service involves the aspect of cooking/preparing during the course of providing service. Thus, supply of ice-cream parlor stands on a different ‘Owing than restaurant service. Their activity entails supply of ice cream as goods (a manufactured item) and not as a service, even if certain ingredients of service are present.

4.3 Accordingly, as recommended by the Council, it is clarified that where ice cream parlors sell already manufactured ice-cream and do not cook/prepare ice-cream far consumption like a restaurant, it is supply of ice cream as goods and not as a service, even if the supply has certain ingredients of service. Accordingly, it is clarified that ice cream sold by a parlor or any similar outlet would attract GST at the rate of 18%.

Circular No. 201/13/2023-GST dated 1.8.2023

Whether supply of food or beverages in cinema hall is taxable as restaurant service:

3. References have been received requesting for clarification whether supply of food and beverages at cinema halls is taxable as restaurant service which attract GST at the rate of 3% or not.

3.1 As per Explanation at Para 4 (xxxii) to notification No. 11/2017-CTR dated 28.06.2017, “Restaurant Service’ means supply, by way of or as part of any service, of goods, being food or any other article for human consumption or any drink, provided by a restaurant, eating joint including mess„ canteen„ whether for consumption on or away from the premises where such food or am’ other article for human consumption or drink is supplied”

3.2 Eating joint is a wide term which includes refreshment or eating stalls: kiosks; counters or restaurant at a cinema also.

3.3 The cinema operator may run these refreshment or eating stalls; kiosks; counters or restaurant themselves or they may give it on contract to a third party. The customer may like to avail the services supplied by these refreshment: snack counters or choose not to avail these services. Further, the cinema operator can also install vending machines, or supply any other recreational service such as through coin-operated machines etc. which a customer may or may not avail.

3. 4 It is hereby clarified that supply of food or beverages in a cinema hall is taxable as ‘restaurant service’ as long as:

a) the food or beverages are supplied by way of or as part of a service, and

b) supplied independent of the cinema exhibition service.

3.5 It is further clarified that where the sale of cinema ticket and supply of food and beverages are clubbed together, and such bundled supply satisfies the test of composite supply, the entire supply will attract GST at the rate applicable to service of exhibition of cinema;. principal supply.

11. We find that the appellant, as is already mentioned supra, is aggrieved only against ruling given in respect of question no. 2, wherein the GAAR held that the readily available food & beverages (not prepared in the restaurant), sold over the counter, is supply of goods & is liable to applicable rate of GST and that it does not qualify as ‘restaurant service’.

12. We find that the definition of ‘restaurant service’, as reproduced supra, means supply of goods viz food/beverages, etc fit for human consumption, provided by a restaurant/eating joint including mess, canteen, Loy way of or as part of any service, irrespective of whether it is consumed at the restaurant premises or otherwise. Now, clause 6(b) of schedule-II, read with section 7(1A), ibid, in a similarly worded sub-clause, mentions activity of supply of food articles…… , by way of or as part of any service, as supply of service. The reason for undertaking a conjoint reading of both the definition and clause 6(b) of schedule-11, is to highlight the fact that to fall within the ambit of ‘restaurant service’, the pivotal factor is that the supply of food has to be a composite supply along with the supply of service. It goes without saying that sans supply of service, a supply of goods being food/beverages, fit Ibr human consumption, is a case of pure supply of goods.

13. The aforementioned finding is substantiated vide the clarification issued vide circular no. 201/13/2023-GST dated 1.8.2023, reproduced supra, wherein it was clarified that supply of food or beverages in a cinema hall is taxable as ‘restaurant service’ as long as the food or beverages arc supplied la way of or as a part of a service….

14. Further this is also what emanates on a conjoint reading of paragraphs 3 and 4 [especially paragraph 4.21 of circular no. 164/20/2021-GST dated 6.1.0.2021, reproduced supra.

15. GAAR vide its ruling to question no. 2, supra, holds that the readily available food & beverages ‘not prepared in the restaurant] sold over the counter by the applicant is supply of goods which is liable to applicable rate of GST & does not qualify as ‘restaurant service’. We find that the ruling is in tune with the definition of restaurant service and the clarifications isfsiled by the CBIC, as mentioned supra. We therefore, concur with the findings of the GAAR.

16. Lastly, the applicant has relied upon two rulings viz

[a] M/s. Kundan Misthan Rhandir 3 . In this case, the AAAR of Uttarakhand, was dealing with a matter wherein the applicant was running a sweetshop and a restaurant, in two distinctly marked separate parts of the same premises in addition to maintaining separate accounts as well as separate billing; that the goods sold from sweetshop were billed exclusively as sweetshop sales whereas the goods supplied from restaurant were billed under restaurant services. IT was held that when the goods are supplied to customers in the restaurant or as a take aways from the restaurant counter it is a composite supply with restaurant service being the principal supply, since food is naturally bundled with the restaurant service. As is apparent, the facts of the case arc not similar and hence, we do not find the reliance to the said ruling tenable. We further also disagree with the findings of the GAAR in para 17, of the impugned ruling, to this extent.

[b] M/s. Gangaur Sweets’ . Again in this case, the AAR, Chhattisgarh, was dealing with a matter wherein the applicant had a sweetshop in the ground floor & a restaurant at the first floor of the same building; that for the supplies made from the restaurant there being supply of preparation & sale of goods & serving the same there exist III supply of two or more goods or services or both together & goods or services or both arc usually provided together in the normal course of business, having all the ingredients of a composite supply. As is evident again, the facts of the case not being similar, the reliance is not tenable.

Even otherwise, the ruling of an Advance Ruling Authority or an Appellate Authority under section 103 of the CGST Act, 2017, is binding only on the applicant & the concerned officer or the jurisdictional officer in respect of the said applicant. Hence, the reliance placed on aforementioned ruling is not plausible.

17. In view of the above findings, we reject the appeal filed by appellant M/s. Riddhi Enterprise, against the Advance Ruling No. GUJ/GAAR/R/2022/51 dated 30.12.2022. passed by the Gujarat Authority for Advance Ruling.