Doms Industries Pvt. Ltd ., In re

Date: January 21, 2025

Subject Matter

Supply of Pencils Sharpener along with Pencils is covered under the category of "Mixed Supply". AAR ruling upheld.

Summary

The case involves an appeal filed by M/s. DOMS Industries P Ltd. against an Advance Ruling issued by the Gujarat Authority for Advance Ruling (GAAR), which ruled that the supply of a product known as DOMS Al pencil kit—a pack of pencils, sharpener, and eraser—constituted a mixed supply, not a composite supply.

Key points include:

- The appellant claimed that the inclusion of the sharpener and eraser with the pencils constituted a composite supply, meaning one of the items was a principal supply.

- Following the GST Council's notification to increase the GST rate on pencil sharpeners and similar products from 12% to 18%, the appellant sought clarity on the nature of their goods, including their proper classification and applicable GST rate.

- The GAAR determined that the pencil and the accessories were not naturally bundled together and concluded that the supply was a mixed supply under GST law. Items classified as mixed supply are taxed at the rate of the highest tax among the supplies included.

- GAAR's findings indicated that the supplies were not made in conjunction with each other in the ordinary course of business, and the criteria for a composite supply were not satisfied. Ultimately, the appeal was rejected by the authority, affirming the GAAR's interpretation that the supply should be treated as a mixed supply, thus attracting higher tax rates and requiring an assessment based on the product with the highest applicable GST rate. The various rulings and arguments presented by the appellant were deemed not legally tenable, which supported the original ruling by GAAR.

FULL TEXT OF THE ORDER OF AUTHORITY FOR APPELLATE ADVANCE RULING, GUJARAT

At the outset we would like to make it clear that the provisions of the Central Goods and Services Tax Act, 2017 and Gujarat Goods and Services Tax Act, 2017 (hereinafter referred to as the ‘CGS]. Act, 2017′ and the `GGST Act, 2017′) are pari materia and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act, 2017 would also mean reference to the corresponding similar provisions in the GGST Act, 2017.

2. The present appeal is filed under Section 100 of the CGST Act, 2017 and the GGST Act, 2017 by M/s. DOMS Industries P Ltd., (hereinafter referred to as Appellant) against the Advance Ruling No. GUJ/GAAR/R/2022/52 dated 30.12.2022.

3. Briefly, the facts are enumerated below for ease of reference:

- the appellant is a manufacturer & supplier of stationery items;

- the applicant supplies the goods in a combination with other products viz

[a] DOMS Al pencil. This consist of 10 pencil along with a sharpener& , eraser.

[b] DOMS Smart Kit. This is a gill pack which consists of a cblouriii2, book, two pack of pencils, one pack of Colour pencil, one pack of oil pastels, one pack of plastic crayons, one pack of wax crayons, one eraser, one scale and one sharpener.

[c] DOMS my first pencil kit. It consists of a pencil, eraser, scale and a sharpener.

- That consequent to the 47th meeting of the GST Council, vide notification No. 6/2022-CT (R), GST rate was increased on pencil sharpener, Scales & mathematical instruments sets from 12% to 18%;

- the applicant feels that he satisfies the four conditions to term the aforesaid supply as ‘composite supply’.

4. In view of the foregoing ‘facts, the appellant had sought Advance Ruling on the following questions, viz:

(i) Whether the supply of pencils sharpener along with pencils being principal supply will be considered as the composite supply or mixed supply?

(ii) What will be the IISN code to he used by us in the above case.

(iii) Whether supply of sharpener along with the kit having a nominal value will have an impact on rate of lax. Ilyes, what will be 11,e rate of tax & IISN code to be used by use.

5. Consequent to hearing the applicant, the Gujarat Authority for Advance Ruling IGAARI, recorded the following findings viz

- the applicant has on his own stated that sharpener & eraser arc included as accessories; that an accessory is not essential to the product;

- the dictionary meaning of accessory suggest that the pencil sharpener & eraser supplied with the pack is not an. integral part of the pencil but it is useful for the pencil;

- pencil sharpener & eraser arc not naturally bundled & all these products cannot be considered as made in conjunction with each other in ordinary course of business;

- the argument that in the industry all the goods arc sold together is not tenable;

- that few in the industry adopt such marketing of supplying he goods together;

- that the products are supplied independently also;

- that the goods arc not naturally bundled;

- that it is very difficult to determine the principal supply;

- that it fulfils all the conditions °la mixed supply;

- that recourse to GRI is not proper since what is being decided is nature of supply and not classification of the product.

6. The GAAR, thereafter, vide the impugned ruling dated 18.10.2021, held as follows:

(i) the supply of pencils sharpener along with pencils is covered under the category of ‘mixed supply’;

(ii) as discussed in para 21.1 of the impugned ruling.

(iii) yes the supply of sharpener along with the kit having a nominal value will have an impact on rate of tax. As discussed in para 21.2 and 21.3 of the impugned ruling.

7. Aggrieved by the aforesaid advance ruling, the appellant is before us, raising the following contentions, viz

- that the IISN code serves as a yardstick for determining the classification of the product whether sold individually or in sets;

- that the mechanism of classification of the goods along with the GIR as stipulated under Customs Law would apply under UST as well;

- that where goods arc classifiable under two or more heading, classification needs to he undertaken based on Rule 3 of GIR;

- that in case of sale of ‘composite goods consisting of different materials/components and goods put up in sets for retail sale, Rule 3(b) of GIR is to be applied;

- explanatory notes define the term ‘goods put up in sets for retail sale’;

- further for determination of the goods which provides essential characteristic, reference can be made to the explanatory notes issued by WCO;

- that since all the conditions as specified in explanatory notes for the term ‘goods put up in sets for retail sale’ is satisfied & since pencil provides the essential characteristic, the IISN code to he used for DOMS Al pencil should he the one applicable;

- GST Council in its 47th meeting recommended change in GST rate vide notification No. 6/2022-CT (R) wherein the (“1ST rate was increased on pencil sharpener & Scales & mathematical instruments sets from 12% to 18%.

- the appellant relies on the ruling passed under US Customs Law on classification of stationery set consisting of two regular pencils;

- that supply of pencils with sharpener and eraser is a composite supply & meets all the conditions;

- that major manufacturers arc following this trade practice since decades;

- that perception of the customer is also a determinant factory;

- that mere marketability of goods/services independently cannot he a decisive factory not to qualify as composite supply;

- that one of the important aspect of principal supply is that the other supply should he ancillary to the principal supply; that the term ancillary is not defined under CGST Act; that they would like to rely on the case of Vareed Jacob I; wherein meaning assigned to word ‘ancillary in the law lexicon as been accepted:

- that the concept of principal supply is similar to Rule 3(b) of GIR, which provides for essential character; that the principles laid down for determining goods providing essential character to a set can also be extended determine the principal supply.

8. Personal hearing in the matter was held on 8.11.2024 wherein Shri Rahul Shah, authorized signatory, Shri Santosh Sonar and Shri Keshar Soni, appeared and reiterated the submissions made in the appeal. During the course of personal hearing a compilation containing copy of the appeal papers already filed, along with copies of the following was submitted

[a] Copy of the ruling passed under US Customs ‘Cross ruling N245467 dated 10.9.20131;

[b] photocopy of images of similar product sold by major industry player:

[c] UST rate changes of pencil sharpener

[d] photocopy of the answer of the I lon’ble the Minister of State for Finance in the Rajya Sabha to unstarred question No. 1043 dated 12.12.2023, along with annexure;

[e] ruling of GAAR in the case of I3aroda Medicare P Ltd 2, Sameera Trading Company3, South Indian Federation of Fishermen Societies, Jainish Anantkurnar Pate15, HP India Sales P I,td6.

FINDINGS

9. We have carefully gone through and considered the appeal papers, written submissions filed by the appellant, submissions made at the time of personal hearing, the Advance Ruling given by the GAAR and other materials available on record.

10. To summarize, the GAAR.. vide its impugned ruling held that supply of sharpener along with pencil, is a mixed supply; that in case of mixed supply, comprising two or more supplies, shall he treated as supply of that particular supply attracting higher rate of tax; that supply of sharpener 1along with kit] having nominal value, will have an impact on rate of tax.

11. on going through the grounds & prayer of the appellant, it is forthcoming that the appellant is aggrieved only in respect of their product `DOMS Al pencil’, which consists of 10 pcs of pencil, one eraser and one sharpener. We therefore, limit our ruling to the said product only.

12. The averment raised by the appellant is that for determination of the goods which provides essential characteristic, reference can be made to the explanatory notes issued by WCO; that as pencil provides the essential characteristic, the I iSN code to be used for DOMS Al pencil should be the one applicable; that supply of pencils with sharpener and eraser is a composite supply & meets all the conditions.

13. This averment stands answered by the GAAR. in para 19. We find that the GAAR has examined it by testing it with the four conditions which need to be satisfied for a supply to fall within the ambit of ‘composite supply’. GAAR has held that supply of 10 pencils, one eraser and one sharpener in a single box, named DOMS Al, is not ‘naturally bundled’, that they are not made in conjunction with each other in ordinary course of business & that none of the supply is principal/predominant supply. We find that in the additional submissions submitted on 8.11.2024, during the course of personal hearing, on page 82, an extract for guidance as per service tax education guide issued by CBIC is placed, wherein under para 9.2.4, the manner of determining if the services arc bundled in the ordinary course of business, is placed, viz

3 Guidance as per Service Tax Education Guide issued by CBIC

9,2.4 Manner of determining if the services are bundled in the ordinary course of business

Wheeler services are bandied in the ordinary course of business would depend upon tne normal or frequent

Practices (snowed in Ine area of business to which services relate. Such normal and frequent practices

adopted in a business .n be ascerta-red inint several indicators some of which are listed below

- The perception of tee consumer or the service receiver If large number of service receivers of such bundle of services reasonably expect such services to tie provided as a package then such 8 package could be treated as naturally bundled in the ordinary course of business.

- Maionty of service providers in a particular area of business provide similar bundle of services For example bundle of catering on board and transport by air is a bundle offered by a majority of airlines

- The nature of the various services in a bundle of services will also help in determining whether the services are bundled in the. ordinary Course of business If the nature of services is such that one of the services is the main service and the other services combined with such service are in the nature of incidental or ancillary services which help in better enjoyment of a main Service. For example service of stay in a hotel is often combined 001 a service or laundering of 3.4 items of clothing free Of cost per day. Such service is an ancillary service to the provision of hotel accommodation and the resultant package would be treated as services Undirect in the ordinary course of business nalnatty Other illustrative indicators not dereopinative bin. indicative of bundling of services in ordinary Couse of business are –

- The perception of tee consumer or the service receiver If large number of service receivers of such bundle of services reasonably expect such services to tie provided as a package then such 8 package could be treated as naturally bundled in the ordinary course of business.

- Maionty of service providers in a particular area of business provide similar bundle of services For example bundle of catering on board and transport by air is a bundle offered by a majority of airlines

- The nature of the various services in a bundle of services will also help in determining whether the services are bundled in the. ordinary Course of business If the nature of services is such that one of the services is the main service and the other services combined with such service are in the nature of incidental or ancillary services which help in better enjoyment of a main Service. For example service of stay in a hotel is often combined 001 a service or laundering of 3.4 items of clothing free Of cost per day. Such service is an ancillary service to the provision of hotel accommodation and the resultant package would be treated as services Undirect in the ordinary course of business nalnatty Other illustrative indicators not dereopinative bin. indicative of bundling of services in ordinary Couse of business are –

>There , a single ,o or me customer pays the same amount, no flatter how much of the package they actuary roe ye ceruse

>The elements are normally advertised as a pacxage.

>The different elements are not available separately.

> The different elements are integral tp one overall supply – it One Or more is removed, the rattan of the supply wand be affected

No straight jacket formula can be laid down to determine Whether a service is naturally bundled ie the ordinary course of business Eacn case has to be indivicluatly examined in the backdrop of several factors Softie of which are outlined above.

14. As is evident, though issued in respect of services, the analogy of the word naturally bundled can he adopted even in respect of goods. The supply in present case, is not naturally bundled as many of the indicators as mentioned supra arc not satisfied. Further, nothing is produced to substantiate the fact that pencil provides the essential characteristic, as far as supply of product DOMS A 1, is concerned. GAAR has further examined whether the product l)OMS Al, meets the condition to fall under the ambit of mixed supply. Consequently, vide the ruling it was held that the product meets with the conditions of mixed supply and that the applicant is required to use the I ISN code of the product which attracts the highest rate of tax among all the taxable supplies containing in a pack/box, in terms of section 8, We, concur with the said findings of the GAAR.

15. The appellant’s next averment is that the I ISN code is a yardstick for determining the classification of the product whether sold- individually or in sets; that the mechanism of classification of the goods along with the GIR as stipulate(i under Customs law applies under GS’I’ also; that where goods are classifiable under two or more heading, classification needs to be undertaken based on Rule 3 of GIR.; that in case of sale of composite goods consisting of different materials/components and goods put up in sets for retail sale, Rule 3(b) of GIR is to be applied; that the explanatory notes define the term ‘goods put up in sets for retail sale’.

16. The relevant extracts of General Rules for Interpretation [GRID of the I ISN, is as under

3. When by application of Rule 2 (b) or for any other reason, goods are, prima facie, classifiable under two or more headings, classification shall be effected as follows:

(a) The heading which provides the most specific description shall be preferred to headings providing a more general description. However, when two or more headings each refer to part only of the materials or substances contained in mixed or composite goods or to part only of the items in a set put up for retail sale, those headings are to he regarded as equally specific in relation to those goods, even if one of them gives a more complete or precise description of the goods.

(b) Mixtures, composite goods consisting of different materials or made up of different components, and goods put up in sets for retail sale, which cannot be classified by reference to 3 (a), shall be classified as if they consisted of the material or component which gives them their essential character, insofar as this criterion is applicable.

(c) When goods cannot be classified by reference to 3 (a) or 3 (b), they shall be classified under the heading which occurs last in numerical order among those which equally merit consideration.

1 7. We note that in paragraph 21.2, GAAR, has addressed the aforementioned contention. The relevant extract of the COST Act, 2017, which governs the nature of the such supply, states as under:

Section 2. Definitions.-

In this Act, unless the context otherwise requires,-

(30) “composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply;

Illustration.- Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply;

(74) “mixed supply” means two or more individual supplies of goods or services, or any combination thereof made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply.

Illustration.- A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drinks and fruit juices when supplied for a single price is a mixed supply. Each of these items can be supplied separately and is not dependent on any other. It shall. not. he a mixed supply if these items are supplied separately,.

Section 8. Tax liability on composite and mixed supplies.-

The tax liability on a composite or a mixed supply shall he determined in the following manner, namely:-

(a) a composite supply comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply; and

(h) a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax.

We find that the CGST Act, defines a composite/mixed supply. Additionally, CGST Act, 2017, thereafter, specifics the tax liability in such case wherein a supply falls within the ambit of either a composite/mixed supply. We have already held that the product `DOMS Al pencil’, is a mixed supply, the product not being naturally bundled, not having a principal supply and not supplied in conjunction with each other in the ordinary course of business. Now, for the sake of argument, even if we were to examine the claim of the appellant, we find that the product of the applicant, in question, would not fall either within Rule 3(a) or 3(b) of the GIR, leaving us with the only alternative of resorting to Rule 3(c). The question then which would arise is whether Rule 3(c) of the GRI or Section 8(b), of the CGST Act, 2017, would prevail. It is a trite law that when the section is unambiguous, the averment of the appellant to take the assistance GRI for deciding the nature of supply, classification and rate of tax, is not legally tenable. We therefore, reject this submission of the appellant.

18. Lastly, the applicant has relied upon various rulings, foreign and others.

[a] US Customs ruling [Cross ruling N245467 dated 10.9.20131. having gone through the tariff classification ruling, we find that it is for a sample identified as Disney Ruler Stationery set, consisting of two regular pencils, one eraser, one pencil sharpener & one ruler. The Ruling classifies the product under 9609100000 by relying on GRI 3(b), holding the pencil to be providing an essential character to the product. However, what needs to be understood is for making a judgement applicable. the facts arc to be similar. Any distinction, would render the reliance, untenable in law. We arc not aware as to whether the definition of composite. mixed supply are the same. Further, there is nothing produced on record, to substantiate, that there is a section in the US customs, similar to Section 8 of the CGST Act, 2017. In view of’ the foregoing, we find that the reliance is not legally tenable.

[b] Rulings in the case of Baroda Medicare P Ltd 7, Sameera Trading Company ; South. Indian Federation of Fishermen Societies, Jainish Anantkumar Patel” and HP India Sales P Ltd”.

We have gone through the facts of the aforementioned rulings. The services/goods involved, not being similar, the reliance on the same is not legally tenable.

19. We have in the earlier paragraphs stated that we concur with the findings and the ruling of the GAAR vide the impugned ruling. However, with the change in the rate, we wish to answer the questions posed for advance ruling as under taking into consideration the change in the rate of GST:

Question 1: Whether the supply of pencils sharpener along with pencils being principal supply will be considered as the composite supply or mixed supply?

Ruling : The supply of pencils sharpener along with pencils under product DOMS Al is covered under the category of ‘mixed supply’.

Question 2: What will be the IISN code to be used by us in the above case.

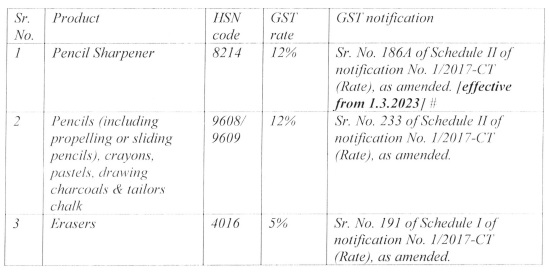

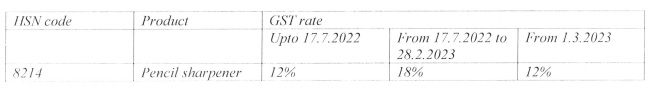

Ruling : In consonance with ruling to question 1, since it is a mixed supply, the TEN code of the supply which attracts the higher rate of among all the taxable supplies contained in product DOMS A1, is required to be used. The present GST rate is as under GST rate is as under.

# changes in the rate of GST in respect of pencil sharpener

Question 3: Whether supply of sharpener along with the kit having a nominal value will have an impact on rate of tax. If yes, what will be the rate of tax & IISN code to be used by use.

Ruling : Yes, the supply supply of the sharpener along with the kit having a nominal value will have an impact on rate of tax. The rate of tax will be 12% and the IISN code, in respect of mixed supply lie product DOMS’ All will be the supply which attracts the higher rate of tax among all the three supplies ie 8214 or 9608 or 9609.

20. In view of the above findings, we reject the appeal filed by appellant M/s M/s. DOMS Industries P Ltd., against Advance Ruling No. GURGAAR/R/2022/52 dated 30.12.2022 of the Gujarat Authority for Advance Ruling.