Ramdev Food Products Pvt. Ltd ., In re

Date: January 21, 2025

Subject Matter

Instant mix flours merit classification at HSN '2106 90' attracting 18% GST. AAR ruling upheld.

Summary

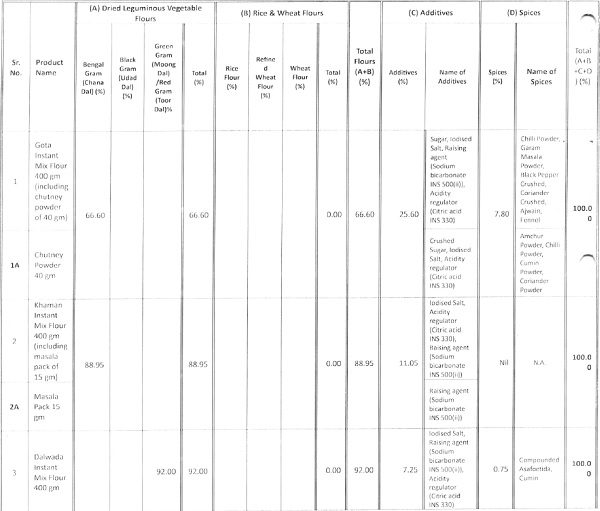

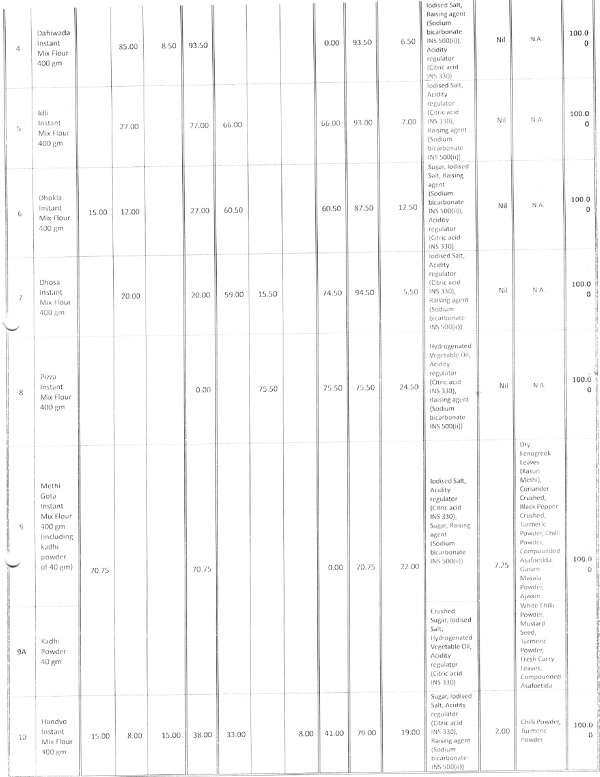

The case involves an appeal filed by M/s. Ramdev Food Products Pvt. Ltd. disputing the Advance Ruling given by the Gujarat Authority for Advance Ruling regarding the classification and GST rate applicable to their instant mix flours. The appellant contended that their products retained their identity as flour and should be classified under HSN codes 1101, 1102, or 1106, attracting a lower GST rate of 5%. - The Gujarat Authority for Advance Ruling classified the products under HSN 2106 90, categorizing them as "Food Preparations not elsewhere specified or included," which attracts a higher GST rate of 18%. - The ruling concluded that the manufacturing process involved mixing flour with various spices and additives, thus changing its essential character to a food preparation rather than pure flour. The appellant’s arguments about the products being naturally bundled and the essential character of flour did not hold, and the appeal was rejected. The distinction between 'ready to eat' and 'ready to cook' was emphasized, confirming the classification under HSN 2106 based on the nature of the product relative to its preparation for consumption. Hence, the conclusion of the appellate authority upheld the findings of the Gujarat Authority for Advance Ruling.

FULL TEXT OF THE ORDER OF AUTHORITY FOR APPELLATE ADVANCE RULING, GUJARAT

At the outset we would like to make it clear that the provisions of the Central Goods and Services Tax Act, 2017 and Gujarat Goods and Services Tax Act, 2017 (hereinafter referred to as the `CGST Act, 2017′ and `GGST Act, 2017′) are pail maleria and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act, 2017 would also mean reference to the corresponding similar provisions in the GGST Act, 2017.

2. The present appeal has been –filed under section 100 of the CGST Act, 2017 and the CGST Act, 2017 by M/s. Ramdev Food Products Pvt. Ltd., Spice World, Sarkhej-I3avla Highway, Changodar, Ahmedabad- 382 213 | hereinafter referred to as appellants’ against the Advance Ruling No. GUPGAAR/R/29/2021 dated 19.7.2021, passed by the Gujarat Authority for Advance Ruling IGAARI.

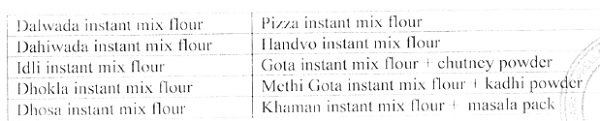

3. The facts briefly arc that the appellant is engaged in the business of manufacture and supply of the below mentioned ten instant mix flours viz

which as per the appellant are not in ‘ready to eat’ but in ‘ready to cook’ form under their registered brand name.

4. Before the GAAR, the appellant submitted that the below mentioned process is undertaken for manufacturing & selling the above products, viz:

(a) that they purchase food grains and pulses from vendors.

(b) that such food grains/pulses arc fumigated and cleaned for removal of wastage.

(c) that food grains/pulses arc then grinded and converted into flour.

(d) that flour is sieved for removal of impurities.

(e) that flour is then mixed with other ancillary ingredients such as salt, spices, etc. The proportion of flour in most of the instant mixes is ranging from 70% to 90%.

(f) that flour mix is then subjected to quality inspection and testing.

(g) that flour mix is thereafter packaged and stored for dispatch.

5. The appellant, before the GAAR also submitted the table showing constituent components of instant mix flours viz:

6. The manufacturing process adopted was provided in the form of a flow chart reproduced at para 4 of the impugned ruling.

7. The appellant further submitted that the instant flour mix retained its identity as flour and therefore is classifiable under heading 1101, 1102 or 1106 as the case may be based on the dominant flour component.

8. In view of the foregoing, the appellant raised the following question before the GAAR viz:

a) What is the applicable rate of tax under the GST Acts on supply of instant mix flours for gota, khaman, dalwada, dahiwada, idli, dhokla, dhosa, pizza. methi gota and handvo?

b) What is the applicable rate of tax under the GS7′ Acts on supply of instant mix flour for gota/methi gota along with chutney powder/kadhi chutney powder?

c) What is the applicable rate of tax under the GST Acts on supply of khaman along with masala pack?

9. Vide the aforementioned impugned order dated 19.7.2021, the GAAR ruled as follows viz:

Ruling

a) The subject 10 goods merit classification at IISN. 2106 90 attracting 18% GS7′ (9% CGSTI 9% SGS7) as per Sl. No. 23 of Schedule-III to the Notification No.01/2017-Central Mx (Rate) dated 28-6-17.

b) The mixed supply of Instant mix flour of Gota/Methi Gota with Chutney powder/Kadi Chutney powder shall be treated as supply of Instant Gota Mix Flour/Instant Methi Gota Mix 1″lour respectively (fulling under IISN 2106 90) on which the GS7′ liability will be 18%(9% CGS7′ 19% SGS7).

c) The mixed supply of Instant mix flour of Khaman and masala pack shall be treated as supply of Instant Mix Flour of Khaman (falling under HSN 2106 90) on which the GS7′ liability will be 18% (9% CGS7′ 9% SGS7).

10. For arriving at the aforementioned ruling, the GAAR, gave the below mentioned findings viz:

- the reliance on VAT Determination order and the case laws cited by the applicant pertaining to VAT regime does not hold ground since GST classification is based on IISN which was not the case with the Schedule-I of the Gujarat Value Added Tax Act, 2003.

- that as far as instant mix flours of Khaman, Gota , Dalwada , dahiwada and Methi (iota is concerned, inspection revealed that each of the packet is marked ‘ Instant Mix’;

- the proportion of spices and additives contained in the above products ranges from 5% to 33.4%; that the products contain spices and additives in different proportions not mentioned in the Chapter I leading 11.06 or the relevant Explanatory Notes of I ISN; that this is not the case of addition of very small amounts of additives;

- that in terms of explanatory notes of IISN in respect of heading 1101 & 1102, flours which have been further processed or had other substances added with a view to their use as food preparations arc excluded; that if other substances (other than specified substances) are added to the flours with a .view to use as ‘food preparations’, then the same gets excluded from the heading 1101 or 1102;

- that products being supplied by the applicant contain spices and additives apart from flour of dried leguminous vegetables, rice and wheat, in different proportions;

- that the difference between idli/dhosa instant mixes and idli/dhosa batters is understood from the images of idli/dhosa hatters, reproduced in the impugned ruling; that instant mix of idli/dhosa arc not idli/dhosa hatters and therefore does not get covered under entry 1102;

- that heading 2106 is not confined to processed or semi processed food, cooked or semi cooked food, preserved food and ready to cat food;

- that goats/methi goats and chutney powder/kadhi chutney powder supply is not naturally bundled and the supply is for a single price; that the supply of Khaman instant mix flour with masala pack is not naturally bundled and the supply is for a single price & hence these supplies fall under mixed supply.

11. Feeling aggrieved, the appellant is before us i.e. Gujarat Appellate Authority for Advance Ruling IGAAARI raising the following averments viz

- that the instant flour mix retained its identity as flour & therefore it is classifiable under heading 1101, 1102 or 1106;

- that proportion of flour and additives in the instant mixes ranges from 92.20% to 100%;

- that there is no specific tariff heading under which instant flour mix can fall;

- that instant flour mix being a mixture of various products would fall under 1101, 1102 and 1106 in view of Rule 3(b) of the General Rules of Interpretation;

- that instant mix supplied with chutney, kadhi, arc composite supply these being naturally bundled and hence is classifiable under the heading .for the principal supply;

- that instant mix flour of idli/dhosa batter fall under specific entry 100A schedule I to notification No. 1/2017 leviable to GST @ 5%;

- that entry 23 of Schedule III of notification No. 1/2017-CT (R), is a residuary entry for food preparations; that to qualify as food preparation under I ISN 2106, the product by itself should he for use for human consumption: that instant flour mix cannot be directly processed for use but they arc first required to he mixed with water, oil, etc & thereafter it is processed for use;

- that the essential character of the instant flour mix is flour and not the additives added to it;

- that the major component of cost and price of the instant flour mix is flour and price of spices and additives is very negligible;

- that by adding water to idli & dhosa mix, these can be prepared as is being prepared from their batter; that therefore the distinction drawn by the AAR is too narrow;

- the ruling of the AAR holding the flour to he falling under entry 23 of schedule III of notification No. 1/2017-CT (R), is not correct since these cannot he straight away cooked !iv preparing food articles for human consumption;

- that AAR has erred in classifying instant mix on the grounds that it contains spices.

In view of the aforementioned averments, the appellant stated that the ten products as listed in paragraph 3 supra are liable to GST @ 5% 12.5% CGST & 2.5 % GST

12. Personal hearing in the matter was held on 08.11.2024 wherein Shri Hardik Bhatt, CA, appeared on behalf of the appellant. I-le reiterated the written submissions made in the appeal. During the course of personal hearing, the appellant submitted additional submissions raising the following – averments viz

- that even though various ingredients arc added to flour as additives, it has been clarified in circular No. 80/54/2018-GST dated 31.12.2018, that ‘Sattu’, falls under IISN code 1106 & is leviable to GST 5%;

- that they would like to rely on the case of IOC ‘, wherein the Hon’ble SC held that officers cannot argue the case against circular issued by the Board;

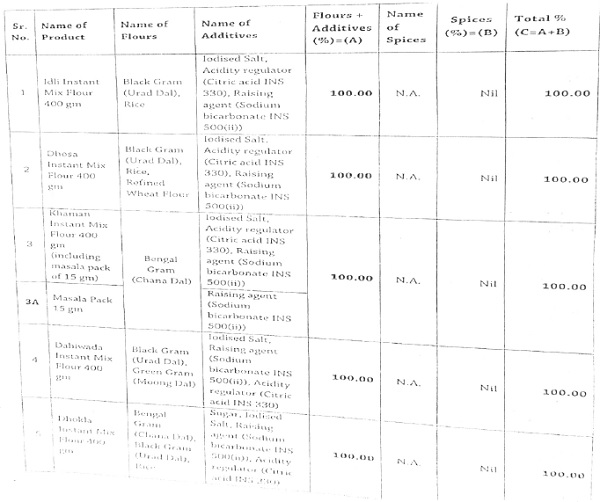

- that Idli, Dhosa, Khaman, Dahiwada and Dhokla arc mixture of flours like Black Gram (Urad Dal) and/or Rice and/or Refined Wheat Flour and/or Bengal Gram (Chang 1)al) and/or Green Gram (Moong Dal)” with addition of very small amount of “additives like iodized Salt and/or Sugar and/or Acidity regulator (Citric acid INS 330) and/or Raising agent (Sodium bicarbonate INS 500(ii)); that it does not contain any spices and hence should be covered as Flours under Chapter 11 & be leviable to GST 5%;

- that they would like to rely on the case of Satnam Overseas Limited2;

- that form of product is not determinative of its classification; that by adding water to idli/dhosa instant mix, batter can be prepared; that denying the benefit of entry 100A of schedule I in respect of GST g 5%, would frustrate the purpose.

- the table showing constituent components of live (5) instant mix flours (without spices) is as under viz

13. We have carefully gone through and considered the appeal filed by the appellant, their written/oral submissions and additional submissions made during the course of personal hearing and the impugned ruling dated 19.7.2021.

14. The issue involved in this case is regarding proper classification and determination of rate of tax in respect of the ten items listed in paragraph 3 above. As is already mentioned supra, GAAR has held that the aforementioned products are classifiable under IISN 2106 90 (Others) attracting 18% GST (9% CGST and 9% SGST).

15. We find that the appellant in his averments has stated that the product would fall under I ISN 1101, 1102 or 1106.

16. Before dwelling on to the issue, we would like to reproduce relevant portions of chapter heading, circular/clarification & notification for ease of

reference viz

1101 00 00 WHEAT OR MESLIN FLOUR

1102 CEREAL FLOURS OTHER THAN THAT OF WHEAT OR MESLIN

1102 20 00– Maize (Corn) flour

1102 90 Other..

1102 90 10—Rye flour

1102 90 90—Other

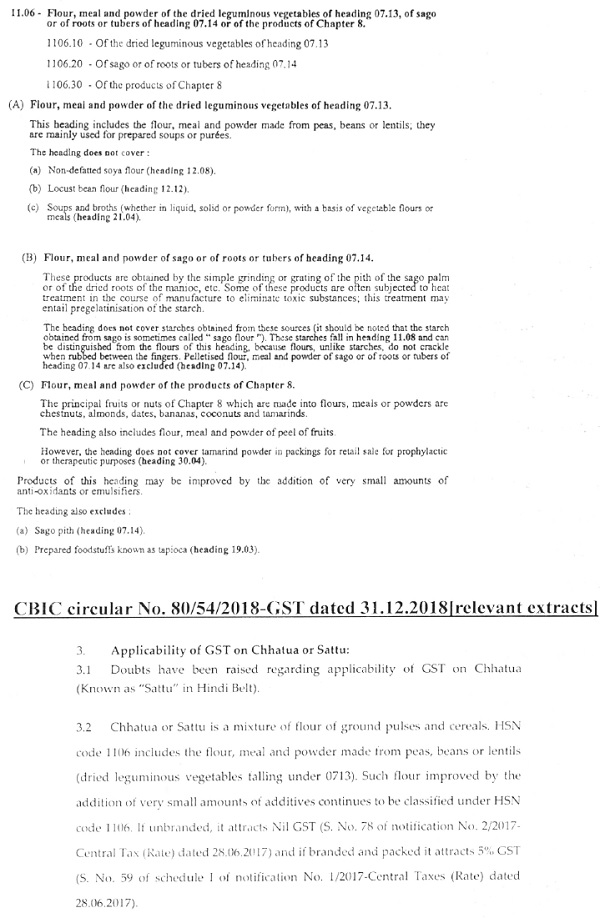

Explanatory notes to USN in respect of Headings 1101, 1102 and 1106 read as under:

11.01 Wheat or meslin flour

This heading covers wheat or meslin flour (i.e. the pulverised products obtained by milling the cereals of heading 10.01) which AO the requirements as to starch content and ash content set out in paragraph (A) of Chapter Note 2 (see General Explanatory Note) and comply with the criterion of passage through a standard sieve as required by paragraph (B) of that Note. Flours of this heading may he improved by the addition of very small quantities of mineral phosphates, antioxidants, emulsifiers, vitamins or prepared baking powders (self raising flour) Wheal flour may be further enriched by an addition of gluten, generally not exceeding 10%. The heading also covers swelling (pregelatinise) flours which have been heat treated to pregelatinise the starch. They are used far making preparations of heading 19.01, bakery improvers or animal feeds or in certain industries such as the textile or paper industries or in metallurgy (for the preparation of foundry core binders). nous which have been further processed or had other substances added with a view to their use as .food preparations are excluded (generally heading 19.01). This heading also excludes flours mixed with cocoa (heading 18.06 if they contain 40% or more by weight of cocoa calculated on a totally defatted basis, or heading 19.01, if less)

11.02 Cereal flours other than of wheat or meslin.

This heading covers flours (i.e. the pulverised products obtained by milling the cereals of chapter 10) other than flours of wheat or meslin. Products of the milling of rye, barley oats, maize (corn) (including whole cobs ground with or without their husks) grain sorghum, rice or buckwheat are classified in this heading as flours if they fulfil the requirements as to starch content and ash content set out in paragraph (A) of Chapter Note 2(see General Explanatory Note) and comply with the criterion of passage through a standard sieve as required by paragraph (B) of that “Vote Flours of this heading may be improved by the addition of very small quantities (?f. mineral phosphates, anti-oxidants, emulsifiers, vitamins or prepared baking, powders (self raising flour). The heading also covers swelling (pregelatinise) flours which have been heatireated to pregelatinise the starch. They are used for making preparations of heading 19.01, bakery improvers or animal feeds or in certain industries such as the textile or paper industries or in metallurgy (for the preparation of foundry core binders). Flours which have been further processed or had other substances added with a view to their use as food preparations are excluded (generally heading 19.01). This heading also excludes flours mixed with cocoa (heading 18.06 if they contain -10% or more by weight of cocoa calculated on a totally detailed basis, or heading 19.01, if less).

17. The appellant’s primary averment is that the essential character of instant mix is flour only and therefore they should fall under HSN 1101, 1102 or 1106 as the case may be and consequently be leviable to GST in terms of schedule I to notification No. 1/2017-CT (R) dated 28.6.2017 @, 5%. on going through para 2(A) of the explanatory notes of I ISN for chapter 11, it is observed that the products from the milling of the cereals listed in the table (wheat and rye, barley, oats, maize and grain, sorghum, rice, buckwheat) fall in this chapter if they satisfy some characteristics. Further, in terms of para 2(13) of the explanatory notes of FISN for chapter 11, products falling in this chapter under the provisions of para 2(A) shall be classified in heading 11.01 or 11.02, if the percentage passing through a woven metal wire cloth sieve with the aperture of 315 micro meters (microns) / 500 micro meters (microns) is not less, by weight than that shown against the cereal concerned, otherwise, they fall in heading 11.03 or 11.04. It has also been inter-alia mentioned that this chapter includes products obtained by submitting raw materials of other chapters (dried leguminous vegetables, potatoes, fruit, etc.) to processes similar to those indicated in paragraph (1) or (2) mentioned therein. Thus, the products from the milling of the cereals, dried leguminous products etc. are covered in chapter 11 of the Customs Tariff Act, 1975.

18. It is the appellant’s averment that instant mix flours of Khaman, Gota, Dalwada, Dahiwada and Methi Gota merit classification under 1ISN 1106. The explanatory note to chapter 1106 is already reproduced supra. However, it would he prudent to reproduce the chapter heading 1106 of Customs Tariff, for case of understanding

Chapter Heading 1106 as per Customs Tariff:

1106 FLOUR, MEAL AND POWDER OF THE DRIED LEGUMINOUS VEGETABLES OF HEADING 0713, OF SAGO OR OF ROOTS OR 711131!:RS OF HEADING 0714 OR OF THE PRODUCTS OF CHAPTER 8:

1106 10 00- Of the drier! leguminous vegetables of heading 0713

1106 20- Of sago or of roots or tubers of heading 0714:

1106 20 10— Of sago

1106 20 20 — Of manioc (cassava)

1106 20 90— Of other roots and tubers

1106 30 – Of the products of Chapter 8:

1106 30 10— Of tamarind

1106 30 20— Of singoda

1106 30 30— Mango .four

1106 30 90— Other

Now, as is evident, chapter heading 11.06 covers “Flour, Meal and Powder of the dried leguminous vegetables of heading 0713, of sago or of roots 0/’ tubers of Heading 0714 or of the products of Chapter 8″. As per Rule 1 of the General Rules for the Interpretation of Customs Tariff Act, 1975, for legal purposes, classification shall he determined according to the terms of the headings and any relative section of chapter notes. Thus, the classification of the product is required to be determined in accordance with the terms of the headings. As per chapter heading 1106, it covers Flour, Meal and Powder of the dried leguminous vegetables of Chapter Heading 07.13 and other specified products. As the products of the appellant contain other ingredients like Iodides salt, Acidity regulator (INS 330), Raising agent (INS 500(ii)) in different proportions, which are not mentioned in the chapter heading 11.06 or the relevant explanatory notes of HSN, we find that the said products arc not covered under Chapter Heading 11.06.

19. The appellant has further stated that circular No. 80/54/2018-GST dated 31.12.2018 is applicable to five (5) instant mix flours viz. Idli, Dhosa, Khaman, Dahiwada and Dhokla which contains very small amount of additives and does not contain any spices. The circular is already reproduced supra. The CBIC has clarified in the aforesaid circular that the flour of ground pulses and cereals, improved by the addition of very small amounts of additives continues to be classified under HSN 1106. However, the said clarification is not applicable in the present case as the products being supplied by the appellant contain other ingredients like iodides salt, acidity regulator (INS 330), raising agent (INS 500(ii)) in different proportions which cannot he held to be in very small amounts, which was not the case with the `Chhatua or Sattu’.

20. The appellant has further contended that instant mix of Idli, Dhokla, Dhosa and Handvo merit classification under 1ISN 1102 whereas Pizza Instant mix merits classification under USN 1101. We find that the flours remain classified under chapter heading 1101 or 1102 even if the flour has been improved by the addition of very small quantities of specified substances. However, if substances (other than specified substances) are added to the flours with a view to use as ‘food preparations’, then the same gets excluded from the chapter heading 1101 or 11.02. A glance at paragraph 5, supra, which mentions the constituent components of the flours and other

ingredients, depict that the various products supplied by the appellant, contain spices and other ingredients apart from flour of dried leguminous vegetaNei4., rice and wheat, in different proportions. The spices and other ingredients contained in these products include sugar, iodised salt, sodium bicarbonate INS 500(ii), citric acid 330, red chili powder, black pepper, coriander, ajwain, fennel, turmeric powder, mustard seed, compounded asafetida, garam masala, etc.. These spices and ingredients arc other than those substances mentioned in the explanatory notes of HSN for chapter heading 1101 or 1102 which could be added in very small quantities to improve or enrich the flours for the resultant product to still remain classified in those chapter headings. The proportion of spices and other ingredients contained in these products is already mentioned in the table supra in paragraph 5. It is also evident from the recipe submitted by the appellant that the spices and other ingredients have been added to the flours for their use as food preparations. The explanatory notes to I-ISN in respect of Heading 1101 and 1102, states that flours of this heading may be improved by the addition of very small quantities of mineral phosphates, anti-oxidants, emulsifiers, vitamins or prepared baking powders (self raising flour). Thus, in view of the explanatory notes of the IISN Instant mix Idli, Dhokla, Dhosa, Handy° and Pizza are excluded from the Chapter heading 1101 and 11.02.

21. The appellant also contended that Idli instant mix flour and Dhosa instant mix flour classifiable under Entry 100A of Schedule I. This averment of the appellant has already been dealt with in the impugned ruling. Nothing is produced before us, compelling us to interfere with the findings as far as this averment is concerned.

22. The next averment of the appellant is that under the VAT determination order, different varieties of flour have been held to be ‘flours’ falling under entry 12 in Schedule Ito GVAI’ Act & that since there is no substantial change in schedule entries, classification and interpretation adopted needs to be followed. The applicant has also relied on the judgement in the case of West Coast Waterbase P Ltd and Samsung India Electronics P Ltd, ibid, to substantiate the averment. We note that the averment stands addressed in paragraph 15 of the impugned order dated 19.7.2021. Further we arc in agreement with the said findings of GAAR.

23. The appellant has further relied on Rule 3(b) of the General Rules of Interpretation 1GRI I, to aver that the product would fall under chapter heading 1102, 1101 or 1106. To substantiate this averment they have relied on the judgement in the case of The Collector of Central Excise v/s Bakelite Hylam Ltd. (1997) 10 SCC 350. We reproduce Rule 3(b) of the GRI, viz

3. When by application of Rule 2 (6) or for any other reason, goods are, prima facie, classifiable under two or more headings, classification shall be effected as follows:

(a) The heading which provides the most specific description shall be preferred to headings providing a more general description. However, when two or more headings each refer to part only of the materials or substances contained in mixed or composite goods or to part only of the items in a set put up for retail sale, those headings are to he regarded as equally specific in relation to those goods, even if one of them gives a more complete or precise description the goods.

(b) Mixtures, composite goods consisting of different materials or made up of different components, and goods put up in sets for retail sale, which cannot be classified by reference to 3 (a), shall be classified as if they consisted of the material or component which gives them their essential character, insofar as this criterion is applicable.

(c) When goods cannot be classified by reference to 3 (a) or 3 (b), they shall he classified under the heading which occurs last in numerical order among those which equally merit consideration

What Rule 3(b), ibid, encapsulates is that mixtures consisting of different material which cannot be classified by reference to 3(a) shall be classified as if they consisted of the material or component which gives them their essential character. The argument put forth is that as the essential character of the instant flour mixes is given by the Flour, so in terms of Rule 3(b) of the GRI, it would fall under chapter heading 1101, 1102 or 1106. The argument is not legally tenable owing to the fact that in the paragraphs above, we have already held that on account of the composition, etc. the product gets excluded from falling under chapter headings 1101, 1102 and 1106. Therefore, the question of relying on Rule 3(b) of the GRI to classify the goods based on the essential character, does not arise. It is owing to this finding, that the averment of the appellant that entry most beneficial to the appellant needs to be preferred, also stands rejected.

24. In view of the foregoing, we hold that none of the products of the appellant merit classification under Chapter 11 of the Customs Tariff Act, 1975 and specifically under Chapter Headings 1101, 1102 or 1106 of the Customs Tariff Act, 1975.

25. As far as the averment regarding classification of instant Gota Mix supplied with chutney powder, Methi gota instant mix supplied with kadhi chutney powder and instant Khaman mix supplied with masala pack, is concerned, the appellant has stated that they arc naturally bundled & hence supplied in conjunction with each other & the GST rate applicable to principal’. supply ie instant mix flour would be applicable. We are in agreement with the findings of GAAR recorded in para 8.3 of the impugned ruling dated 19.7.2021 and hold that it is a mixed supply.

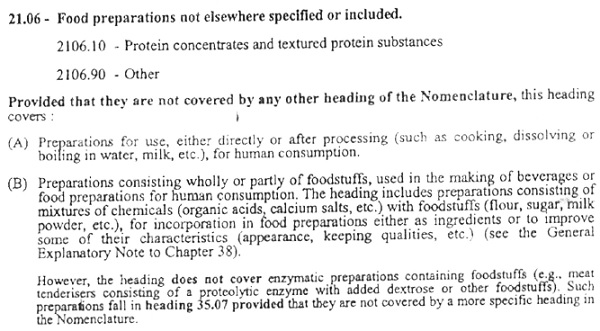

26. The appellant we find has also questioned the classification of the products in question by GAAR under HSN 2106 90, which covers “Food Preparations not elsewhere specified or included’. The appellants further averment is that it can neither be consumed by human in the form they are sold & are not ready to eat products. We reproduce the IISN explanatory notes [relevant extracts] for the ease of understanding viz

As is evident from the explanatory notes, it covers food preparations not elsewhere specified or included. Further of 21.06 covers the preparation for use, either directly or after processing (such as cookies dissolving or boiling in water, milk, etc.) for human consumption, and preparations consisting wholly or partly of foodstuffs, used in the making of beverages or food preparations for human consumption, are classifiable under Chapter I leading 21..06 of the CFA, 1975.

27. The appellant has already stated that his 10 products of mix flour / instant mix flour are preparations consisting wholly of foodstuffs viz. flours of leguminous vegetables and cereals as well as spices and condiments, and these products are used in the making of food preparations for human consumption. It is a fact that these products are preparations for use, after processing, such as cooking, dissolving or boiling in water, milk, etc., for human consumption. Thus, we are of the view that all the aforementioned 10 products of Mix flour Instant Mix flour are appropriately classifiable under chapter heading 2106, more so since they arc not mentioned under any other headings. Further as these products arc not specifically mentioned under any specific Tariff Item of Chapter Heading 2106 of the CIA, 1975, these products are classifiable under the residuary entry i.e. Tariff Item 2106 90 as “Other”.

28. The appellant has further also submitted that the Mix Flour / Instant Mix Flour is not a ready-to-eat food. In this regard, we observe that Chapter Heading 21.06 and specifically Tariff Item 2106 90 is not confined to processed or semi processed food; cooked or semi cooked food, preserved food and ready to eat food. In fact, any product which is a food preparation and which is not elsewhere specified or included in the CIA, 1975, gets covered under Chapter Heading 2106 of the CIA, 1975. Therefore, merely because the end consumer of the Instant Mix Flour is required to follow certain food preparation processes before such product(s) can be consumed, is no ground to take these products out of Chapter Heading 21.06 of the CIA, 1975.

29. We agree with the findings and the ruling of the GAAR vide the impugned order dated 19.7.2021 in so far as classification of the ten products and the rate of GST is concerned. The Appellant, we find has not produced anything compelling us to interfere with the findings of the GAAR.

30. The aforementioned findings are also substantiated by the appellate advance ruling in the case of (a) Shri Dipak Kumar Kantilal Chotai (Talod Geuh Udyog (No. GUJ/GAAAR/APPEAL/2021/17, dated 21.05.2021) (b) M/s. Kitchen Express Overseas Ltd (No. GUJ/GAAAR/APPEAL/2024/01, dated 29.05.2024 and [c] M/s Krishna Bhavan Foods and Sweets (No. TN/AAAR/02/2022, dated 13.01.2022.

31. In view of the above findings, we reject the appeal filed by appellant M/s. Ramdev Food Products Private Ltd. against Advance Ruling No. Guj/GAAR/R/29/2021 dated 19.7.2021, passed by the Gujarat Authority for Advance Ruling.