The government will likely collect more Goods and Services Tax (GST) this financial year than it expected to, with a continuous rise in the monthly mop-up suggesting the Budget estimate for 2023-24 could be revised upwards when Finance Minister Nirmala Sitharaman presents the Interim Budget for 2024-25 on February 1, 2024.

In the first eight months of 2023-24, total GST collections have amounted to Rs 13.32 lakh crore, 12 percent more than what was collected in April-November 2022. Monthly collections have also been going up steadily ever since the new indirect tax regime was rolled out on July 1, 2017, as Sitharaman has told Parliament.

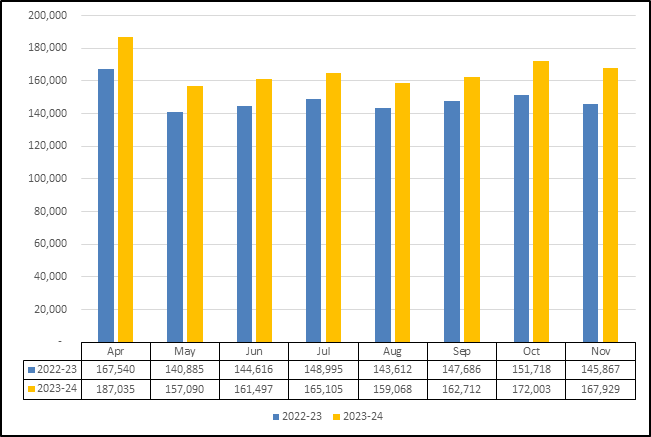

"GST collection rose to a record high of Rs 1.87 lakh crore in April 2023. Further, monthly GST collection during current financial year has crossed the Rs 1.50 lakh crore-mark each time till now," the finance minister said in response to a question in the Lok Sabha on December 4.

Source: Finance Ministry (figures in Rs crore)

Source: Finance Ministry (figures in Rs crore)

As per the latest data for November, released on December 1, GST collections have stayed above above the Rs 1.5-lakh-crore mark for nine consecutive months. The data for November also took the average monthly collection in 2023-24 to Rs 1.67 lakh crore, up from Rs 1.51 lakh crore in 2022-23, Rs 1.24 lakh crore in 2021-22, Rs 94,734 crore in 2020-21, Rs 1.02 lakh crore in 2019-20, Rs 98,114 crore in 2018-19 and Rs 89,885 crore in 2017-18.

Indirect tax collection data for December will be released by the finance ministry on January 1.

With the Indian economy growing faster than anticipated - GDP growth in July-September came in at 7.6 percent, beating all estimates - the GST mop-up may likely exceed what the 2023-24 Budget had projected. In this year's Budget, the finance ministry had forecast that the Centre's GST collections would rise 12 percent from 2022-23 to Rs 9.57 lakh crore.

The total GST collection comprises Central GST, State GST and Integrated GST. While the Central GST, or CGST, is credited to the Consolidated Fund of India, the State GST is given to states. The Integrated GST is settled between the Centre and states and union territories every month on the basis of place of consumption and cross-utilisation of Input Tax Credit.

According to Motilal Oswal Financial Services, at the current run rate, GST collections could exceed the 2023-24 target by about Rs 80,000 crore. "However, a slowdown in January-March 2024 could reduce monthly GST collections," the brokerage added.

Economists, including those at the Reserve Bank of India, widely expect GDP growth to slow down in the second half of the year. According to the central bank, growth will cool down from 7.6 percent in July-September 2023 to 6.5 percent and 6 percent in the final two quarters of 2023-24.

"The healthy growth in GST collections is enthusing, although it may partly reflect the later onset of the festive season this year," said Aditi Nayar, chief economist at ICRA. "We expect CGST collections to modestly exceed the budget estimates."

Money Control