FULL TEXT OF THE JUDGMENT/ORDER OF BOMBAY HIGH COURT

1 Director of petitioner one Muthukrishnan Iyyappan appeared as party in person. Therefore, we requested Mr. Raichandani to be the Amicus Curiae. Before we proceed with the case, we must express our appreciation for the assistance rendered and endeavour put forth by Mr. Raichandani, learned Amicus Curiae, for it has been of immense value in rendering the judgment.

2 On or about 5th April 2019 petitioner received an email from GST audit team stating that there was a service tax paid and payable mismatch for Financial Years 2014-2015 to 2017-2018 and directed petitioner to produce documents for the said period. Petitioner was also requested to pay the difference immediately. The difference indicated was only Rs.1/- and we are unable to understand why petitioner did not choose to pay the amount and close the file. Instead, as we would note, petitioner has willingly chosen to take an arduous route and is now ready and willing to pay a sum of Rs.22,00,414/- as service tax for Financial Years 2014-2015, 20152016, 2016-2017 and 2017-2018.

3 It is stated in the petition that petitioner conducted an internal audit and found that the amount of Rs.22,00,414/- was short paid. Petitioner thereafter, decided to take advantage of Sabka Vishwas Legacy Dispute Resolution Scheme (SVLDRS) and filed a declaration in Form-1 under the voluntary disclosure category declaring a sum of Rs.16,04,367/-. This declaration was filed on 6th November 2019. This was accepted by respondents and petitioner was called upon to make the payment within 30 days. Petitioner did not make the payment but instead filed another declaration dated 30th December 2019 under the category – Investigation, Enquiry or Audit, sub-category – Investigation by Commissionerate and declared the amount of Rs.22,00,414/- as the quantified amount.

4 This declaration was rejected by respondents on the ground that as per respondents’ records the tax dues had not been quantified before 30th June 2019 and hence, it is not covered under the investigation category. The rejection was on the ground of ineligibility and the remarks read as under :

As per records, tax dues has not been quantified before 30.6.19, hence it is not covered under ‘Investigation’ category. It is ineligible as per Section 125(1)(e) read with Sec 121(r) of the Scheme. Further, as per Section 127 (2) and (3), only in case of difference in tax dues declared & ‘estimates’ arrived by Designated Committee, PH may be granted. Hence, your request for PH could not be accepted.

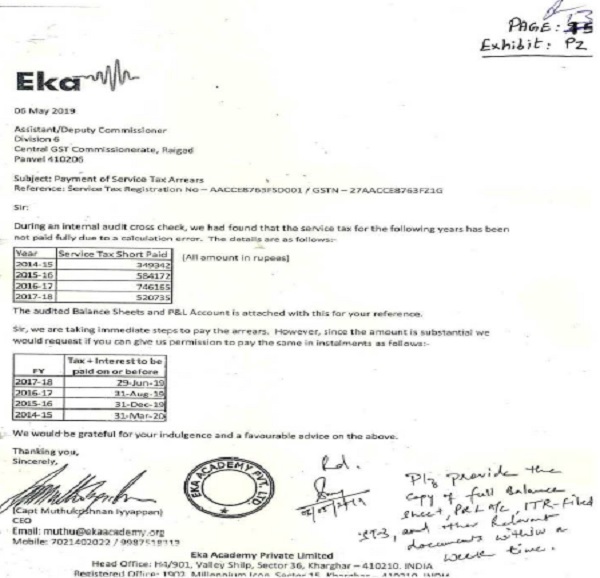

5 It is petitioner’s case that by a letter dated 6th May 2019 petitioner informed respondents that the service tax for Financial Year 2014-2015 upto 2017-2018 was short paid due to a calculation error and the amount totals to Rs.22,00,414/-. A copy of the letter dated 6th May 2019, for ease of reference, is scanned and reproduced hereinbelow :

6 As regards the hand written notes, petitioner stated that it was written by an officer to whom the letter was delivered. The written note states “please provide the copy of full Balance Sheet, P & L A/c., ITR – filed ST-3, and other relevant documents within a week time”. Petitioner received an email dated 5th August 2019 from respondents calling upon petitioner to pay the short payment of service tax amounting to Rs.22,00,414/- together with interest and penalty.

7 Mr. Raichandani, relying upon a judgment of this Court in Thought Blurb v/s. Union of India and Ors.1 and Joseph Daniel Massey v/s. Union of India and Ors.2 submitted that the fact that petitioner had quantified the amount payable before the cut off date of 30th June 2019 read with the email dated 5th August 2019, the Court should hold that petitioner’s tax dues were quantified on or before 30th June 2019.

8 Ms. Date opposed the petition and submitted, relying on a judgment of the Delhi High Court in Chaque Jour HR Services Pvt. Ltd. v/s. Union of India3, that petitioner’s unilateral letter will not amount to quantification of the tax liability. Ms. Date also relied upon a judgment of this Court in JSW Steel Limited v/s. Union of India and Ors.4

9 Both the judgments relied upon by Ms. Date will not be applicable to the facts of this case. In Chaque Jour HR Services Pvt. Ltd. (Supra), petitioner had not quantified the entire tax dues. In that case, petitioner had only admitted service tax liability and did not make any disclosure with respect to the other tax dues. In the case of JSW Steel Limited (Supra), the Court came to a finding that petitioner has not been able to demonstrate and/or there was nothing on record to indicate that the duty liability is admitted by petitioner. In the case before us, by its letter dated 6th May 2019 petitioner has admitted a sum of Rs.22,00,414/- as payable and respondents in its letter dated 5th August 2019 called upon petitioner to pay that amount.

In Thought Blurb (Supra) also respondent no.3, i.e., the Department, in its letter before the cut off date of 30th June 2019 quantified the service tax liability for the period 1st April 2016 to 31st March 2017 at Rs.47,44,937/- and for the second period from 1st April 2017 to 30th June 2017 there was a letter dated 18th June 2019 of petitioner addressed to respondent no.3 admitting service tax liability for an amount of Rs.10,74,011/- which was again before the cut off date of 30th June 2019. The Court held that thus petitioner’s tax dues were quantified on or before 30th June 2019. Paragraphs 47 to 49, 52, 54 and 55 of Thought Blurb (Supra) read as under :

47. Reverting back to the circular dated 27th August, 2019 of the Board, it is seen that certain clarifications were issued on various issues in the context of the scheme and the rules made thereunder. As per paragraph 10(g) of the said circular, the following issue was clarified in the context of the various provisions of the Finance (No.2) Act 2019 and the Rules made thereunder :-

“(g) Cases under an enquiry, investigation or audit where the duty demand has been quantified on or before the 30th day of June, 2019 are eligible under the scheme. Section 2(r) defines “quantified” as a written communication of the amount of duty payable under the indirect tax enactment. It is clarified that such written communication will include a letter intimating duty demand; or duty liability admitted by the person during enquiry, investigation or audit; or audit report etc.”

48. Thus as per the above clarification, written communication in terms of section 121(r) will include a letter intimating duty demand or duty liability admitted by the person during enquiry, investigation or audit etc. This has been also explained in the form of frequently asked questions (FAQs) prepared by the department on 24th December, 2019.

49. Reverting back to the facts of the present case, we find that on the one hand there is a letter of respondent No.3 to the petitioner quantifying the service tax liability for the period 1st April, 2016 to 31st March, 2017 at Rs.47,44,937.00 which quantification is before the cut off date of 30th June, 2019 and on the other hand for the second period i.e. from 1st April, 2017 to 30th June, 2017 there is a letter dated 18th June, 2019 of the petitioner addressed to respondent No.3 admitting service tax liability for an amount of Rs.10,74,011.00 which again is before the cut off date of 30th June, 2019.

Thus, petitioner’s tax dues were quantified on or before 30th June, 2019.

xxxxxxxxxxxxxxxxxx

52. We have one more reason to take such a view. As has rightly been declared by the Hon’ble Finance Minister and what is clearly deducible from the statement of object and reasons, the scheme is a one time measure for liquidation of past disputes of central excise and service tax as well as to ensure disclosure of unpaid taxes by a person eligible to make a declaration. The basic thrust of the scheme is to unload the baggage of pending litigations centering around service tax and excise duty. Therefore the focus is to unload this baggage of pre-GST regime and allow business to move ahead. We are thus in complete agreement with the views expressed by the Delhi High Court in Vaishali Sharma Vs. Union of India, MANU/DE/1529/2020 that a liberal interpretation has to be given to the scheme as its intent is to unload the baggage relating to legacy disputes under central excise and service tax and to allow the business to make a fresh beginning.

xxxxxxxxxxxxxxxxxx

54. As discussed above, though the scheme has the twin objectives of liquidation of past disputes pertaining to central excise and service tax on the one hand and disclosure of unpaid taxes on the other hand, the primary focus as succinctly put across by the Hon’ble Finance Minister in her budget speech is to unload the baggage of pending litigations in respect of service tax and central excise from pre-GST regime so that the business can move on. This was also the view expressed by the Board in the circular dated 27th August, 2019 wherein all the officers and staff working under the Board were called upon to partner with trade and industry to make the scheme a grand success which in turn will enable the administrative machinery to fully focus in the smooth implementation of GST. This is the broad picture which the officials must have in mind while considering an application (declaration) seeking amnesty under the scheme. The approach should be to ensure that the scheme is successful and therefore, a liberal view embedded with the principles of natural justice is called for.

55. Thus having regard to the discussions made above, we hold that rejection of the application (declaration) of the Petitioner under the scheme communicated vide email dated 27th January, 2020 is not justified. Consequently, the same is hereby set aside and quashed. Designated Committee is directed to decide the application (declaration) of the petitioner dated 12th December, 2019 afresh after giving an opportunity of hearing to the petitioner who shall be informed about the date, time and place of hearing. Such decision shall be taken keeping in mind the discussions made above and shall be in the form of a speaking order with due intimation to the petitioner.

10 In Joseph Daniel Massey (Supra) also it was petitioner who had addressed a communication specifically mentioning the service tax amount due and in the declaration also mentioned the same amount as duty payable and since petitioner’s letter was dated 22nd May 2018, the Court gave a finding that petitioner had admitted liability before the cut off date of 30th June 2019. Paragraph 19 of Joseph Daniel Massey (Supra) reads as under :

19. In so far the present case is concerned, it is evident that petitioner in his letter dated 22nd May, 2018 addressed to respondent No.3 had specifically mentioned that the service tax amount due to be paid by the petitioner was Rs.40,95,110.00. In his declaration in terms of the scheme he mentioned the duty payable as Rs.40,91,524.00 which amount corresponds to the quantification arrived at by respondent No.4 post 30th June, 2019 at Rs.40,91,524.00. When petitioner had admitted duty liability of a slightly higher figure much before the cut off date of 30th June, 2019, it would be too technical and narrow an approach to reject the declaration of the petitioner on the ground that the said figure was arrived at by the respondents after 30th June, 2019. In our view such an approach would defeat the very object of the scheme which is liquidation of past disputes of central excise and service tax so that trade and industry can move on while at the same time the administrative machinery can fully focus in the smooth implementation of Goods and Services Tax (GST). In Thought Blurb (supra) it was held as under :-

“54. As discussed above, though the scheme has the twin objectives of liquidation of past disputes pertaining to central excise and service tax on the one hand and disclosure of unpaid taxes on the other hand, the primary focus as succinctly put across by the Hon’ble Finance Minister in her budget speech is to unload the baggage of pending litigations in respect of service tax and central excise from pre-GST regime so that the business can move on. This was also the view expressed by the Board in the circular dated 27th August, 2019 wherein all the officers and staff working under the Board were called upon to partner with trade and industry to make the scheme a grand success which in turn will enable the administrative machinery to fully focus in the smooth implementation of GST. This is the broad picture which the officials must have in mind while considering an application (declaration) seeking amnesty under the scheme. The approach should be to ensure that the scheme is successful and therefore, a liberal view embedded with the principles of natural justice is called for.”

11 Therefore, in our view, the amount payable has been quantified before 30th June 2019. In the circumstances, respondents shall constitute a Committee to decide the declaration that was filed by petitioner on 30th December 2019 and, on or before 30th September 2024, dispose the same in accordance with law.

12 Petition disposed accordingly.

13 In view of the above, the show cause notice dated 21st September 2021 issued to petitioner is also quashed and set aside. Accordingly, impugned orders dated 18th August 2021 and 31st March 2022 are also quashed and set aside. Consequently, the appeal filed by petitioner before the Central Excise Service Tax Appellate Tribunal (CESTAT) being Appeal No.86611 of 2022 filed on 4th July 2022 also stands disposed.

14 Petitioner is directed to forward a copy of this order to the Registrar, CESTAT for information and necessary action within one week from the date of this order being uploaded.

1 2020-TIOL-1813-HC-MUM-ST

2 2021-TIOL-217-HC-MUM-ST

3 2020 (9) TMI 9 (Delhi)

4 2021 (10) TMI 990 (Bom.)